Retail Media’s Fragmented Stack Problem: The True Cost of Multi-Server Architecture

Retail media has been in a steady state of acceleration. In the United States alone, retail media spending is projected to exceed $62 billion in 2025, according to eMarketer’s latest forecast, and is expected to grow faster than all other digital channels. This accelerated momentum has created a rush amongst retailers to build RMNs from scratch or blend different ad tech solutions together to stand up an RMN quickly.

While retailers race to capture this opportunity, many are building a fragmented retail media stack where multiple servers run isolated auctions with separate mediation layers. This approach promises potential scalability but delivers hidden costs that compound across every aspect of operations.

The scope of the challenge is significant. BCG’s cross-market survey reveals that more than 80% of retailers with existing retail media operations cited three or more major challenges when launching and expanding their programs. These challenges include difficulty with internal ways of working, the lack of advanced tech, and talent acquisition, which are all signs of underlying structural complexity.

These operational challenges stem directly from the complexity of the architecture. Each additional server in a fragmented stack requires dedicated engineering resources to maintain separate systems, creates increased operational overhead to manage disparate reporting systems, and often results in revenue leakage. The complexity of managing multiple vendor relationships drives up both direct costs and opportunity costs as teams spend valuable time troubleshooting instead of optimizing performance.

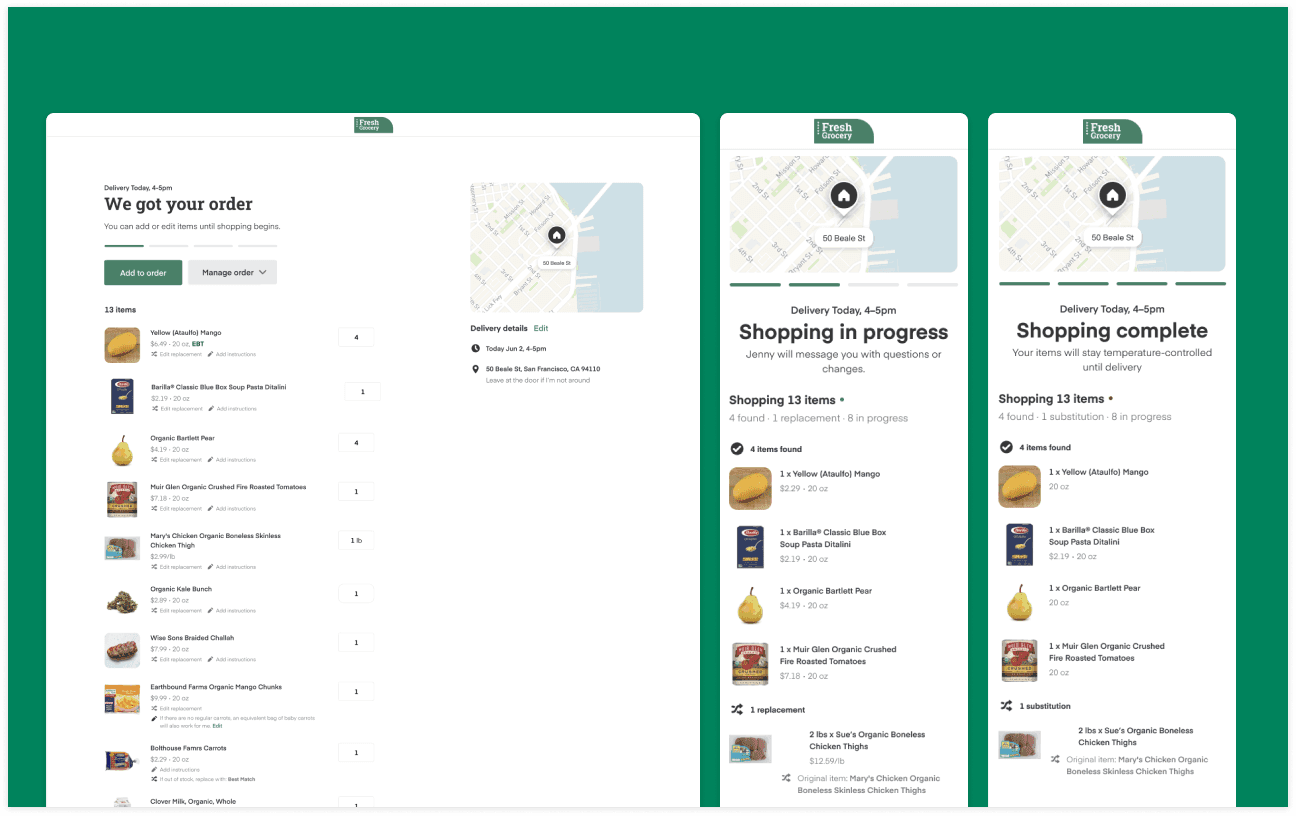

Single-server architecture offers a different approach. By consolidating all demand sources through one unified ad tech platform, it addresses these core challenges while maximizing both performance and sustainability without the overhead that diverts resources. This is the principle behind Instacart’s Carrot Ads, an enterprise-grade, unified retail media technology platform designed to scale with businesses of all sizes while maintaining the trust and transparency that advertisers demand.

But what does this architectural choice actually mean in practice? To understand the true impact of infrastructure decisions on retail media performance, it's essential to examine how single-server and multi-server models differ in their day-to-day operational realities.

Single-server vs. multi-server architecture

The choice between multi-server and single-server models represents more than a technical preference. It defines the entire trajectory of the retailer’s advertising ecosystem’s performance, efficiency, and growth potential.

In multi-server setups, each server runs its own isolated auction and creates longer onboarding cycles, higher latency, fragmented reporting, and redundant workflows. Winning bids from these isolated auctions then compete through additional mediation layers — a step that can introduce uncertainty around measurement, transparency, and trust, especially because auction methodologies can vary across servers.

This fragmentation also forces advertisers to duplicate campaigns, leading to the counterproductive scenario where brands compete against themselves, artificially inflating their own costs.

Single-server setups eliminate these friction points. All demand sources compete within one unified auction environment, with measurement flowing through a single reporting layer. Advertisers save on time and effort with unified campaign set up. This approach aims to maximize yield while potentially reducing the total cost of ownership. Consistent auction methodologies deliver clearer attribution and earn higher advertiser trust by eliminating the risk of self-competition across fragmented systems.

Quantifying the cost layers

The architectural differences translate into measurable business impact across five distinct areas. Unlike isolated inefficiencies that can be addressed individually, these layers compound in multi-server environments, potentially creating a cumulative drag on profitability and growth.

Onboarding delays

Consider a retailer partnership with multiple providers. Each integration requires separate technical workstreams: catalog mapping, tagging, and campaign migration. Since ad operations can’t fully launch until every workstream is complete, this could create 8–12 weeks of additional lag time per integration.

With a fragmented tech stack, multiply this delay across every vendor you integrate with. In a sequential integration scenario, this could add up to 36 weeks of lost revenue, potentially resulting in almost half of the year without ad revenue. And if the retailer has an existing RMN, it could result in additional time spent ramping down from your existing operations.

A unified platform approach streamlines onboarding through one integration, migrating existing campaigns seamlessly and activating new formats without duplicating effort.

With the foundation laid across API integrations, SDK advancements, and expanded partner types, Carrot Ads is designed to help retailers to activate revenue the moment campaigns go live. What could require months of setup and coordination with the fragmented tech stack can now happen in weeks, supported by turnkey onboarding, pre-connected advertiser demand, and built-in optimization models that begin learning from day one.

Carrot Ads enables overall faster time-to-market and revenue activation from the moment campaigns go live.

Auction yield

In siloed auction environments, a beverage brand bidding through one server cannot compete directly with a snack brand bidding through another for the same impression opportunity. This prevents retailers from identifying the highest value advertiser for each placement.

Unified auctions are shown to consistently drive stronger outcomes by ensuring every eligible impression is exposed to maximum competition. In fragmented setups, bids are evaluated in silos, leading retailers to settle for “second-best” outcomes instead of capturing the true market value of their inventory. Over time, this fragmented approach suppresses effective impressions and limits overall monetization potential.

Single-server models ensure all bids compete in one auction, making it more likely to deliver a higher-value ad for each impression.

Carrot Ads operates on a single-server auction framework where all eligible bids, across RTD (Retailer-Targeted Demand), RSD (Retailer Sourced Demand), and syndicated demand (national demand from over 7500+ CPG brands that participate in the Instacart Ads ecosystem) compete head-to-head in real time. This unified structure reduces inefficiencies common in multi-server architectures, leading to improved yield per impression and better optimization for both retailers and brands.

Carrot Ads improves yield optimization on impression opportunities

Consumer experience

When a consumer browses a grocery site with multiple mediation layers stitched together, each additional server call introduces delays before the page fully renders. This disrupts the shopping experience and may cause abandonment if the experience feels sluggish.

Consumers now expect frictionless digital experiences, making site speed and responsiveness critical drivers of conversion.

With a single-server approach, Carrot Ads consolidates all of the mediation logic at its core, removing unnecessary hops, delivering faster load times, smoother navigation, and a more seamless, conversion-supporting experience.

Carrot Ads improves site performance, smoother navigation leading to better consumer experience.

Measurement gaps

Advertisers increasingly expect a single view of performance across all servers. In fragmented stacks, a campaign running through different servers may report impressions and clicks differently, creating confusion and eroding advertiser confidence.

TheAssociation of National Advertisers (ANA) reports that more than half of marketers (55%) point to inconsistent measurement standards across retail media platforms as their greatest concern, with 48% expressing concerns about accurately connecting advertising spend to sales outcomes. As a result, brands may feel uncertain about how spend contributes to actual sales and hesitant to scale budgets.

Carrot Ads’ centralizes all reporting within one unified system, ensuring measurement is consistent across channels. Retailers and advertisers gain a single source of truth and actionable performance data they can trust.

Carrot Ads enables improved advertiser trust and potentially expands budget allocation

Operational overhead

Managing multiple servers requires retailer teams to navigate different dashboards, reconcile mismatched data exports, and coordinate billing disputes across vendors. Add to this resources spent on maintaining the several integrations across the fragmented tech stack. If retail media networks continue to operate with predominantly manual processes, then the operational complexity could be particularly burdensome.

Retailer sales teams may have to explain conflicting performance numbers from two different systems to an advertiser, consuming valuable time and leaving room for errors.

Carrot Ads eliminates this duplication by using consolidated workflows, one reporting environment, and retailer-defined set of permissions. This streamlines the technical workload, reducing operational drag so retailers can redeploy IT resources toward growth-oriented projects that improves customer experience and accelerates revenue.

Carrot Ads streamlines technical workload to help retailers redeploy resources

Path forward: Unified infrastructure for sustainable growth

The evidence across industry research, analyst insights, and operational realities points to a clear conclusion: Single-server architecture provides the foundation retailers need to capture the substantial growth projected for retail media.

While multi-server setups may appear flexible, they introduce the very fragmentation that prevents retailers from reaching their full monetization potential. The cumulative impact of onboarding delays, measurement inconsistencies, and operational overhead creates ongoing drag that becomes increasingly difficult to overcome.

For advertisers, this means greater clarity and confidence. For retailers, they deliver increased monetization potential. With retail media ad spending projected to experience substantial growth in the upcoming years despite economic headwinds, selecting the appropriate infrastructure architecture becomes essential for sustainable success.

Ready to unlock the full potential of your retail media operations?

Discover how Instacart Carrot Ads can help you consolidate demand, maximize yield, and build stronger advertiser relationships through our enterprise-grade, unified platform.

Instacart

Author

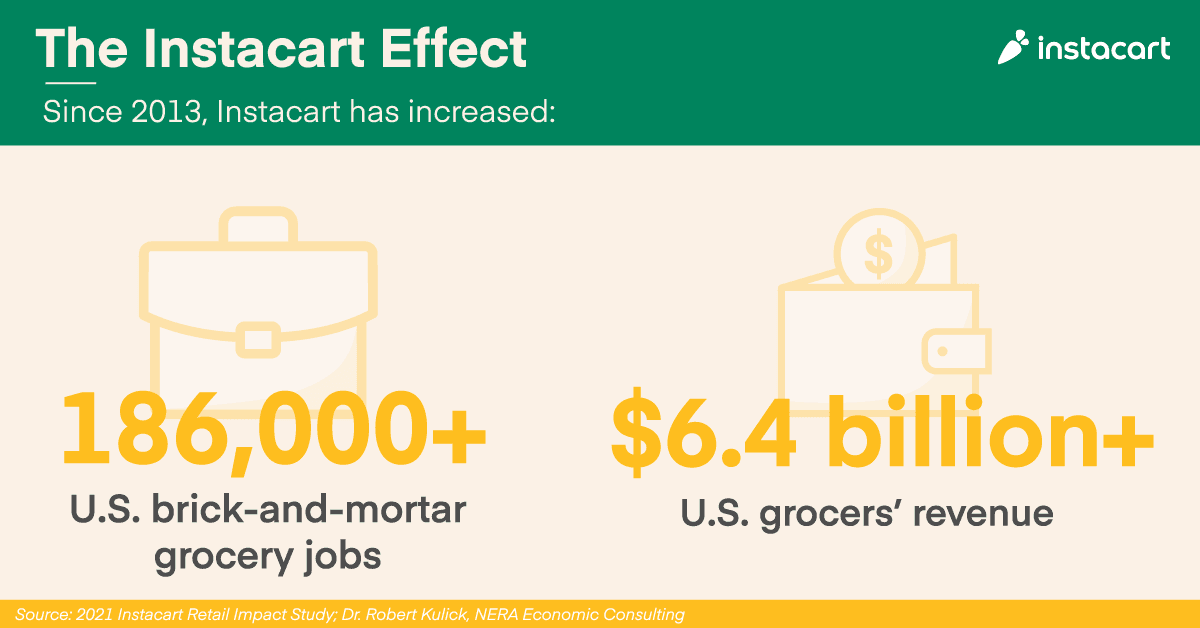

Instacart is the leading grocery technology company in North America, partnering with more than 1,800 national, regional, and local retail banners to deliver from more than 100,000 stores across more than 15,000 cities in North America. To read more Instacart posts, you can browse the company blog or search by keyword using the search bar at the top of the page.